Sales Slowdown Continues, Prices Show Mixed Signals Across 416 & 905

The Greater Toronto Area real estate market continued to adjust in December 2025, with lower sales activity across all property types and moderate price declines year over year.

While demand remains subdued, the data reveals important differences between Toronto (416) and the surrounding GTA (905) markets—especially when it comes to condos and entry-level homes.

Overall Market Snapshot

Total Sales: 4,947 transactions across the GTA

Detached homes still command the highest prices, but sales volumes remain well below last year

Condo apartments account for the largest share of total transactions, despite the steepest decline in sales

This suggests a market that is price-sensitive, cautious, and driven primarily by affordability.

Detached Homes: High Prices, Lower Activity

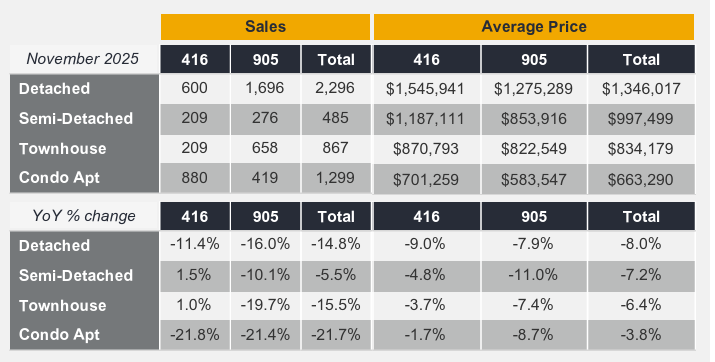

Detached homes saw 2,296 sales GTA-wide, with notable declines year over year:

Sales change:

416: -11.4%

905: -16.0%

GTA total: -14.8%

Average prices:

416: $1,545,941

905: $1,275,289

GTA average: $1,346,017

Prices are down approximately 8% GTA-wide, showing that even premium properties are not immune to current market pressures. Buyers remain cautious, particularly at higher price points.

Semi-Detached Homes: Relative Stability in Toronto

Semi-detached homes posted 485 total sales, with an interesting divergence:

416 sales increased by 1.5% YoY, while

905 sales declined by 10.1%

Average prices declined across the board, but less dramatically than other segments:

GTA average price: $997,499 (-7.2% YoY)

This segment continues to attract buyers looking for a compromise between space and affordability—especially within Toronto.

Townhouses: Sales Drop, Prices Hold Better

Townhouses recorded 867 sales, with sharp volume declines, particularly in the 905:

Sales change:

416: +1.0%

905: -19.7%

GTA total: -15.5%

Despite weaker sales, price declines remain relatively moderate:

GTA average price: $834,179 (-6.4%)

Townhomes continue to appeal to first-time buyers and downsizers, but many are waiting for clearer signals on interest rates.

Condo Apartments: Most Affected Segment

Condos remain the most active segment by volume (1,299 sales)—but also the most impacted year over year:

Sales change:

416: -21.8%

905: -21.4%

GTA total: -21.7%

Average prices:

416: $701,259 (-1.7%)

905: $583,547 (-8.7%)

GTA average: $663,290 (-3.8%)

While prices in Toronto condos are holding relatively steady, the 905 condo market is under more pressure, largely due to higher inventory and investor pullback.

What This Means for Buyers and Sellers

For Buyers:

Less competition than last year

More negotiating power, especially in condos and detached homes

Better selection, particularly in the 905

For Sellers:

Pricing strategy is critical

Overpriced listings are sitting longer

Well-presented, correctly priced homes are still selling

Final Thoughts

The December 2025 GTA market reflects a continued rebalancing rather than a collapse. Sales are down, prices have adjusted, and buyers are cautious—but opportunities exist on both sides of the transaction.

In markets like this, local knowledge, accurate pricing, and strong marketing make the difference between a sale and a stale listing.